Shared Expenses

How to Share Expenses as a Couple

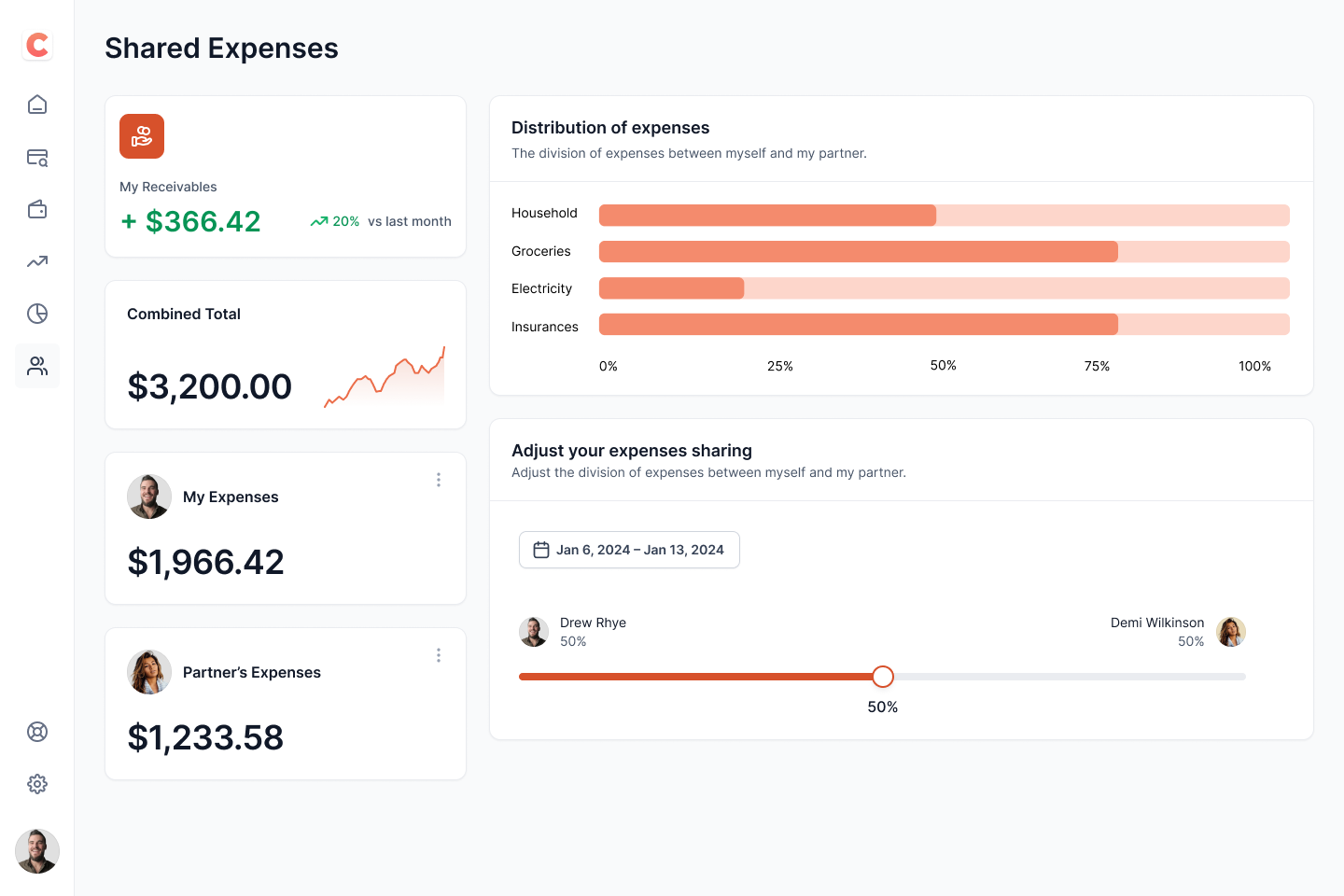

Creating an effective budget is a priority for many couples and housemates, especially when finances are shared. With Cash Fuse, it’s never been easier to track shared expenses and avoid misunderstandings. Our app allows two people to collaborate in managing a household budget with ease, while promoting communication and transparency. Whether you live with your partner or share a home with a friend, Cash Fuse is designed to make managing shared finances smoother.

How does it work?

Cash Fuse simplifies shared expense management. When you make a transaction, you just need to mark it with a simple check, and that expense will automatically be added to the shared expenses page. This way, you can instantly see who paid for what and how much each person owes the other. No more complicated calculations or endless discussions about who paid for groceries or dinner!

Using Cash Fuse, you can also better anticipate upcoming expenses and adjust your couple’s budget based on your financial priorities. This helps avoid surprises and allows better planning for your common goals, whether it’s vacations, home projects, or saving for a major purchase.

Splitting Expenses

One of the most challenging aspects of managing a couple’s budget is fairly dividing shared expenses. Every couple has a different financial situation, so there’s no universal method for dividing costs. With Cash Fuse, you can easily apply the method that best suits your situation, whether it’s based on income, a fixed approach, or a custom strategy. Here are some of the most commonly used strategies for managing shared expenses.

Proportional to Income

This method is particularly useful when the two partners have unequal incomes. Each person contributes to shared expenses based on what they earn. For example, if one person earns 60% of the household’s total income, they would cover 60% of the expenses, while the other would cover the remaining 40%. This strategy is often seen as fair, as it takes into account each person’s financial ability.

For example, if the monthly expenses amount to $2000 and one partner earns $3000 while the other earns $2000, they will split the expenses as follows:

- First partner: 60% ($1200)

- Second partner: 40% ($800)

Equal Split

This method divides shared expenses equally, regardless of income. It is generally used in situations where both people have similar incomes or when the relationship is based on strict equality, regardless of financial ability. It’s a simple approach that avoids complex calculations, but it can sometimes create tensions if one partner earns significantly more than the other.

If the couple or housemates share $2000 in monthly expenses, each person will contribute $1000.

Fixed Split by Category

In this approach, expenses are divided based on preferences or responsibilities. For example, one person might take care of rent or the mortgage, while the other pays for groceries, utilities, or entertainment. This method allows for flexibility, especially when one person prefers to manage certain aspects of the budget or when it’s easier for one partner to cover specific expenses.

For example:

- Rent/mortgage: $1200 (covered by one partner)

- Groceries and electricity: $800 (covered by the other partner)

Finding the Strategy That Works for You

With Cash Fuse, you can easily track your expenses, no matter the method you choose. Whether you opt for a proportional or fixed split, our app lets you check shared expenses and see them automatically appear on the dedicated page, making it easier to manage your family or couple’s budget.

By choosing a clear strategy and using Cash Fuse, you avoid financial misunderstandings and tensions, allowing you to focus on what really matters: maintaining a harmonious relationship and effective financial management.

Sign Up for Early Access and Enjoy a Lifetime Discount!

To thank our early users, we offer a preferential lifetime discount to all who sign up during this early access period.

- Lifetime Discount

- Enjoy an exclusive discount on our subscription, applicable for life.

- Priority Access

- Be the first to try our new features and updates.

- Premium Support

- Receive priority and dedicated support for all your questions and needs.

- Product Influence

- Your feedback will be crucial in helping us perfect our product before its official launch.