How It Works?

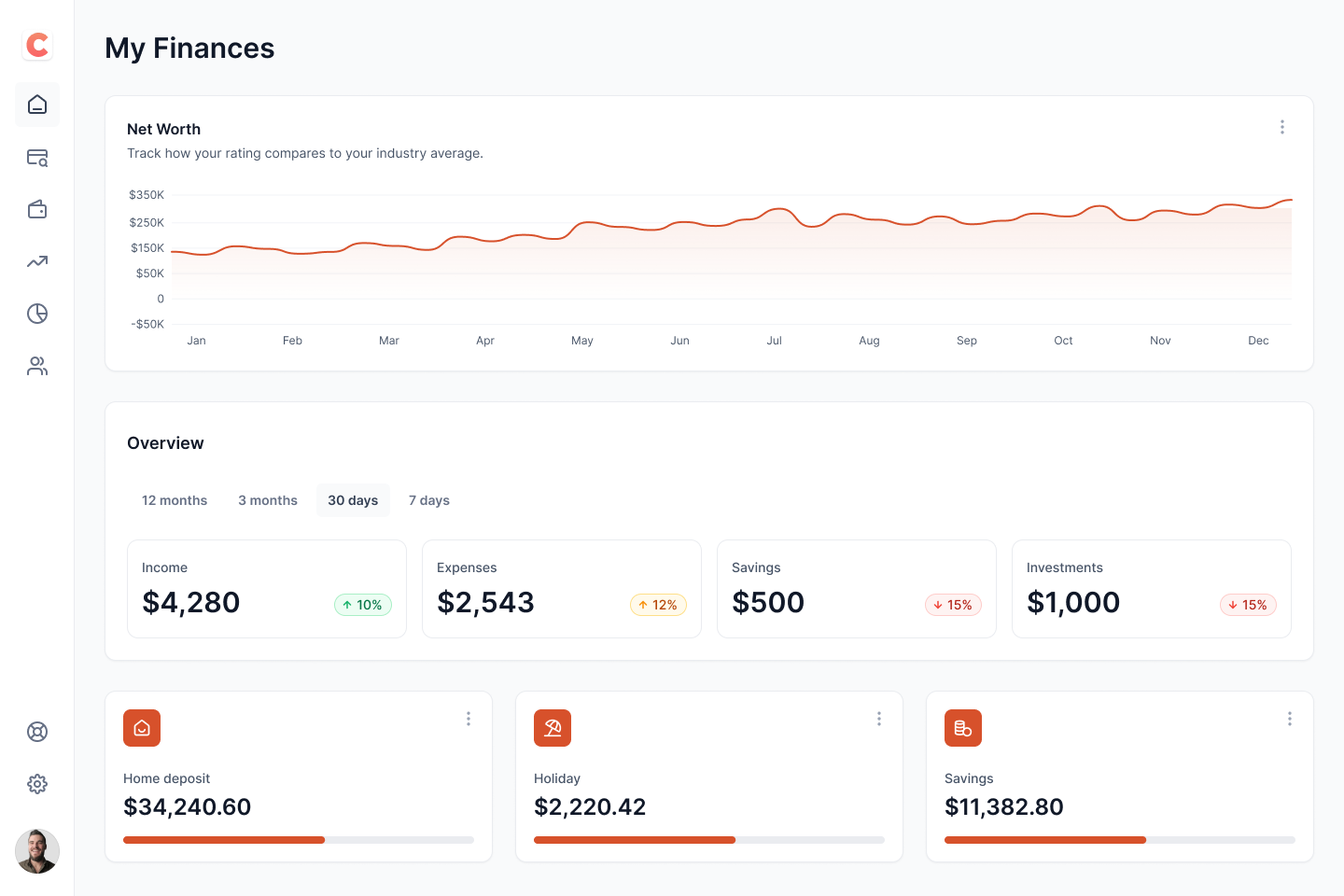

Cash Fuse is an app that helps you take control of your personal finances while keeping control of your data. Our app securely retrieves your banking transactions without using data providers.

From the first use, you will get a complete financial overview and a roadmap for healthy financial habits. We will guide you through three easy steps to establish a solid foundation to start from:

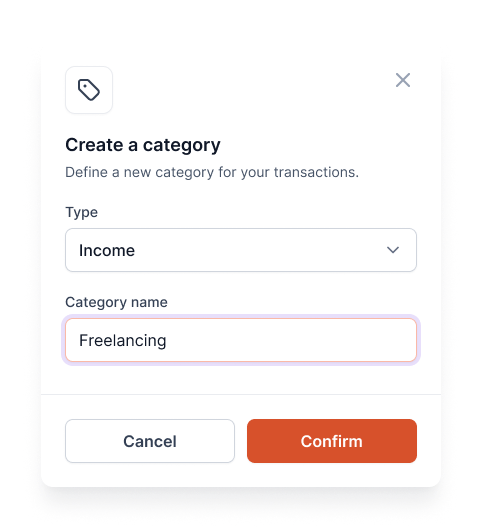

1. Categorize

Classify your income and expenses into different categories (such as housing, food, transportation, entertainment, health, and savings) to better understand where your money is going. This categorization will help you easily visualize your spending habits and identify areas where you can save.

2. Budget

Set specific amounts for each category based on your priorities and financial goals. This allows you to plan and control your spending more effectively. By allocating precise budgets to each area, you can manage your money better and reach your financial goals faster.

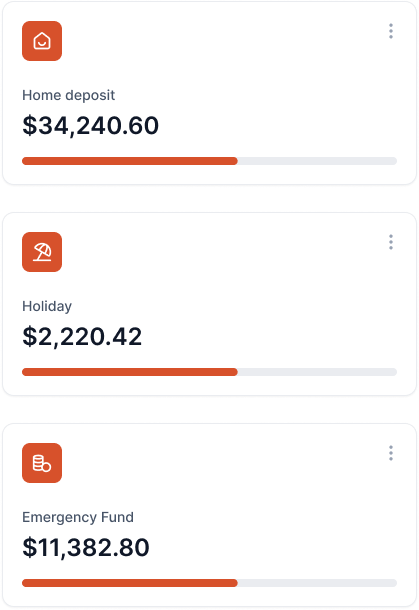

3. Save

Allocate a portion of your income to savings to build an emergency fund and invest in your financial future. Make saving a regular priority. Canadians save an average of only 5% of their income, according to Statistics Canada. By saving regularly, you can strengthen your financial security and prepare for your future with greater peace of mind.

Sign Up for Early Access and Enjoy a Lifetime Discount!

To thank our early users, we offer a preferential lifetime discount to all who sign up during this early access period.

- Lifetime Discount

- Enjoy an exclusive discount on our subscription, applicable for life.

- Priority Access

- Be the first to try our new features and updates.

- Premium Support

- Receive priority and dedicated support for all your questions and needs.

- Product Influence

- Your feedback will be crucial in helping us perfect our product before its official launch.