Without Intermediaries

Intermediaries and Data Providers

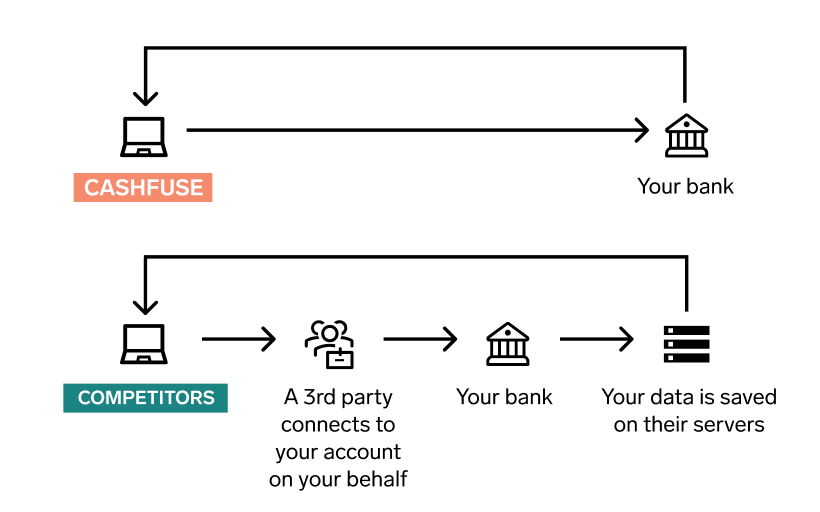

Most personal finance applications work with data providers to retrieve your banking information. These providers mainly operate without the approval of financial institutions. They act as intermediaries between personal finance applications and financial institutions.

Data providers operate in a grey area. Currently, in Canada, there is no defined standard allowing financial institutions to share their data with their customers. Therefore, data providers must use alternative means to retrieve your information. Using automated processes, they connect to your bank's portal with your login information and retrieve your financial data.

Protecting Your Data and Privacy

To provide services to their partners, data providers do not limit themselves to recording your login information. They record all operations performed on your accounts:

- Login ID and password

- Account numbers

- Account balances, credit card, mortgage

- All transactions and their recipients

- Your debts, salary, investments

- Complete picture of your financial situation

- Your spending trends

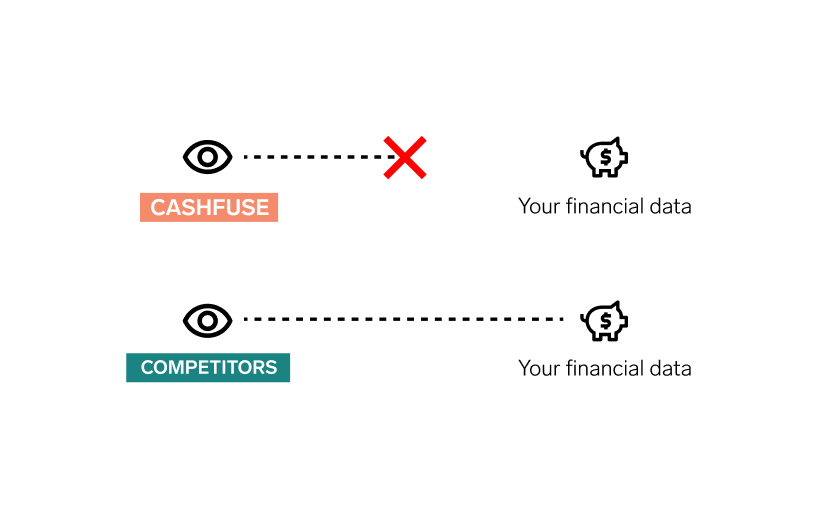

Financial data are among the most sensitive and sought-after information on the Internet. Their exposure to unauthorized third parties presents a significant risk to the financial and personal security of individuals. The consequences of unauthorized access to these data can be devastating.

Among the risks involved are identity theft, where criminals use the information to open fake accounts, take out loans, or make online purchases in the victim's name. Financial fraud is also a major threat, where fraudsters can empty bank accounts, make unauthorized transactions, or even obtain loans using stolen information.

Moreover, the violation of privacy is a growing issue, where details of spending habits and transactions can be exploited for advertising targeting or even sold to third parties without the individual's consent.

A False Promise of Security

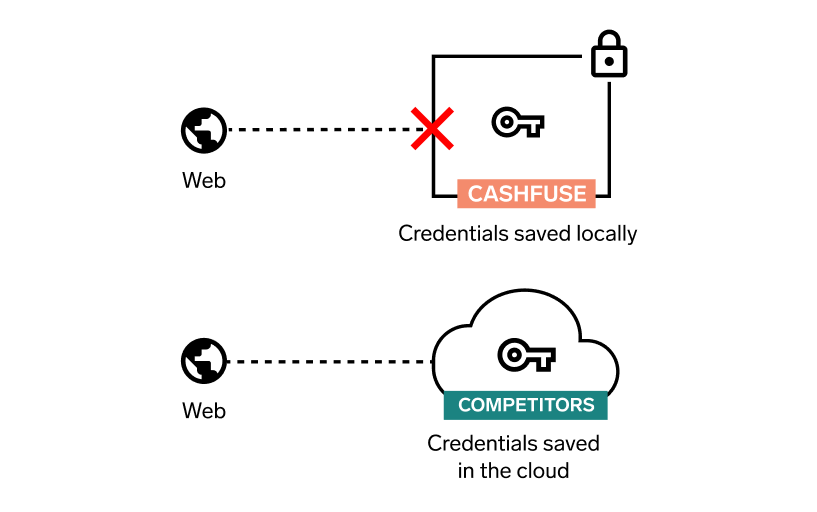

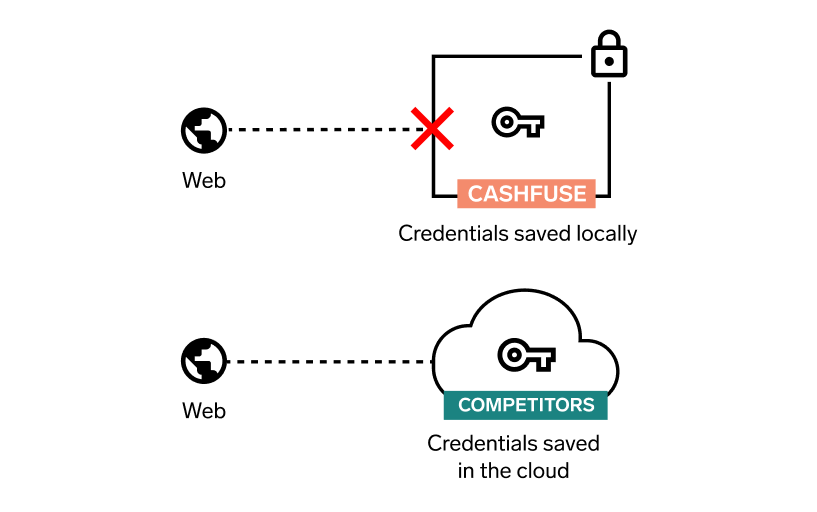

Although data providers claim to adhere to the highest security standards, there is a clear gap in this promise: your login information is recorded. To illustrate, imagine a sophisticated security system equipped with cameras, but the key is left under the doormat. Even if your login information is encrypted when stored, a malicious individual could potentially decrypt it.

Storing your financial data further increases the risk of leakage. The more data providers in possession of your financial information, the more you multiply the risks of leaks, as you must trust each of these intermediaries for the security of your data.

By adopting a decentralized approach, we eliminate this risk of leakage, as each client holds their own data.

Awaiting Open Banking

Open Banking is an approach aimed at allowing customers to share their financial data between different authorized actors in a secure and transparent manner. It is about giving customers more direct control over their banking and financial data, allowing them to share it with third parties, such as other banks, fintech startups, or third-party services, with their consent.

In Canada, Open Banking is a concept that is gaining increasing interest, but there is not yet a complete regulatory framework in place to support it. However, some initiatives have been launched to explore and develop the possibilities of Open Banking in the country.

As long as there is no regulatory framework around financial data sharing and financial institutions do not have incentives, intermediaries will remain the only way to obtain these data.

Our Commitment

Cash Fuse was founded on the very principle of refusing to use data providers. It is against our principles to operate a business that exploits consumer data without their knowledge. We are proud to use NO data providers.

With Cash Fuse, YOU are the intermediary. The application connects to your financial institution and retrieves your data without leaving your device. No financial data is recorded outside your device.

Sign Up for Early Access and Enjoy a Lifetime Discount!

To thank our early users, we offer a preferential lifetime discount to all who sign up during this early access period.

- Lifetime Discount

- Enjoy an exclusive discount on our subscription, applicable for life.

- Priority Access

- Be the first to try our new features and updates.

- Premium Support

- Receive priority and dedicated support for all your questions and needs.

- Product Influence

- Your feedback will be crucial in helping us perfect our product before its official launch.