Becoming The Best Budget App In Canada

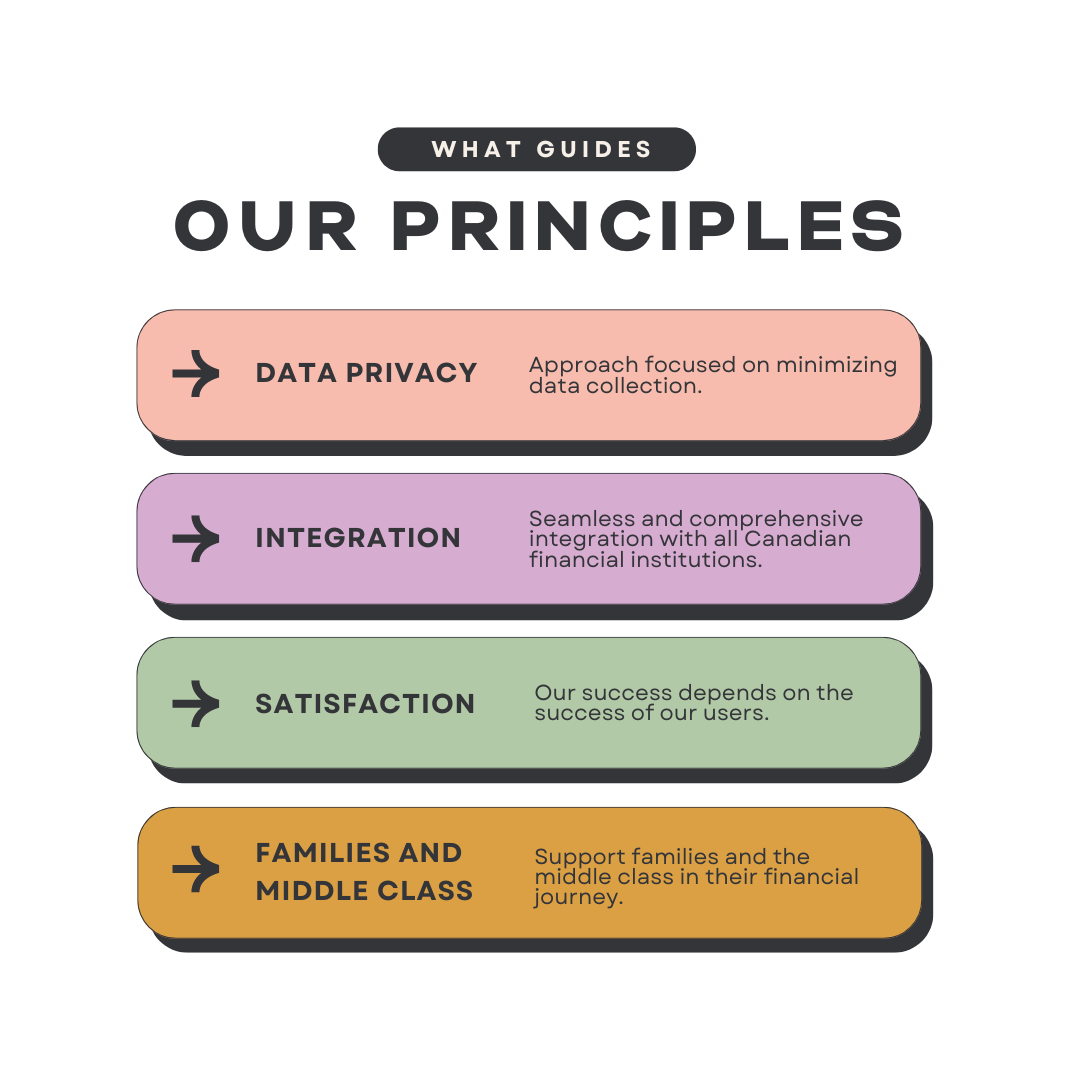

Financial management is becoming increasingly complex in an inflationary and/or recessionary system. Our ambition is to become the reference in budgeting applications in Quebec and throughout Canada. We are committed to offering a solution that meets the needs of the middle class and families, while adhering to the highest standards of privacy, security, and integration with Canadian financial institutions. Here’s how we plan to achieve this.

Absolute priority on privacy and data minimization

Privacy is a major concern for us. That’s why we have adopted an approach focused on minimizing data collection. Unlike other budgeting apps that gather a large volume of personal data, we are committed to collecting only the information strictly necessary to provide an effective service. Additionally, all data we handle is secured with best practices in cryptography and access management, ensuring total confidentiality.

Robust integration with Canadian financial institutions

One of the pillars of our strategy is based on smooth and comprehensive integration with all Canadian financial institutions. We know that to be truly useful, our app must be able to easily connect to our users’ bank accounts, regardless of their financial institution. Our team works daily to ensure full integration with institutions, allowing our users to centralize all their financial management in one place. This enhanced integration results in real-time updates to their finances, enabling them to make informed decisions at any time.

Customer relationship and guaranteed satisfaction

Customer satisfaction is at the heart of our approach. We firmly believe that our success is tied to that of our users. To achieve this, we offer exceptional customer service, available to answer all questions and proactively resolve issues. We regularly measure customer satisfaction and use their feedback to continuously improve our app. Our goal is simple: every user should not only be satisfied but also sufficiently impressed to recommend our app to others.

Long-term vision and adaptation to open banking

We are committed to a long-term vision that anticipates developments in the financial sector, including open banking. We believe that open banking represents the future of financial management. That’s why we stay informed about the latest standards and actively prepare to integrate it as soon as it becomes available, offering our users even greater control over their finances and increased customization of our services. Our aim is to actively contribute to the promotion and adoption of this innovation in Canada, helping our clients through this transition.

Focus on the middle class and families

The middle class and families are the backbone of our society. Our mission is to support them in their financial journey by providing tailored tools that help them achieve their goals. Whether it’s saving for the future, repaying debts, or planning family projects, our app is designed to meet these specific needs. By helping our users reach their financial goals, we firmly believe that our own success will follow.

By placing our users at the center of our approach, we are confident that we will become the best budgeting app in Quebec and Canada, and that our growth will be directly linked to the financial success of those who trust us.

Sign Up for Early Access and Enjoy a Lifetime Discount!

To thank our early users, we offer a preferential lifetime discount to all who sign up during this early access period.

- Lifetime Discount

- Enjoy an exclusive discount on our subscription, applicable for life.

- Priority Access

- Be the first to try our new features and updates.

- Premium Support

- Receive priority and dedicated support for all your questions and needs.

- Product Influence

- Your feedback will be crucial in helping us perfect our product before its official launch.